FOR IMMEDIATE RELEASE

Media Contact:

Gabriella Peak +44 (0)207 290 6551 or gpeak@greenstreetadvisors.com

Green Street’s European Commercial Property Outlook

Green Street’s European Commercial Property Outlook Reveals Increasing Bifurcation of European Property Sectors

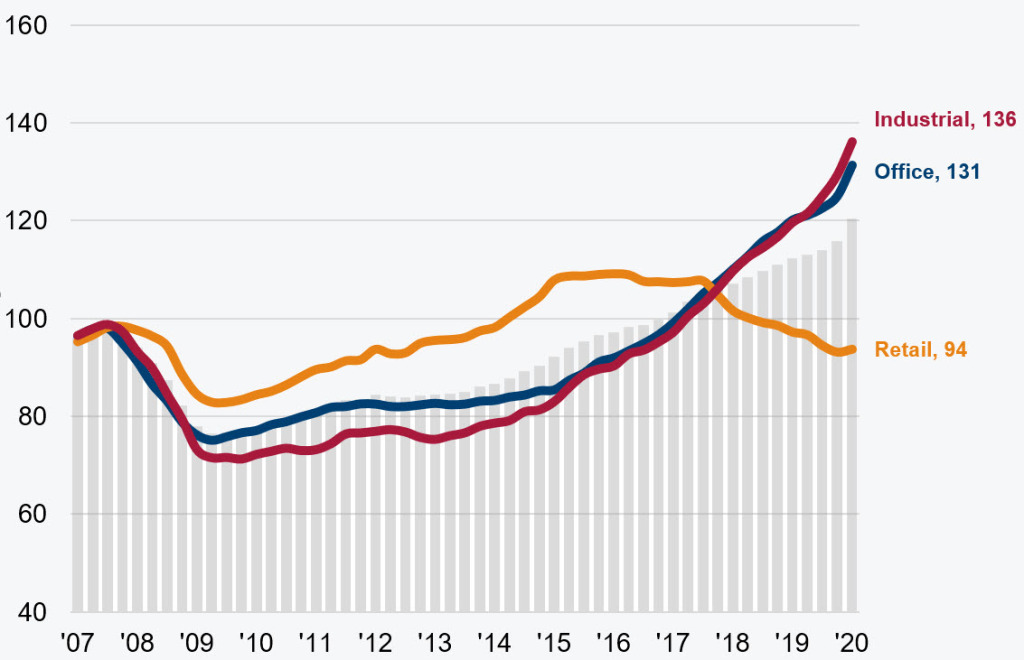

London, United Kingdom – 16 January 2020: Green Street’s European Commercial Property Outlook exposes the increasing divergence visible among European real estate sectors. While asset values for office and industrial sectors are at all-time highs (up circa 10%) and yields are at all-time lows, this is in stark contrast to retail, which is undergoing a paradigm shift due to ecommerce. Over the next five years, operating fundamentals in the industrial and office commercial real estate sectors are expected to outperform retail by circa 20%¹.

Green Street Pan-European Commercial Property Price Index

Pan-European retail spending growth remains in positive territory; however, with ecommerce likely in the middle of a robust growth phase, Green Street believes brick-and-mortar retail sales will continue suffering. The result is negative for retail real estate, but largely positive for industrial, stemming from strong tenant demand – especially for locations close to population centers with lower-than-average ecommerce penetration rates.

Despite retail woes, Green Street notes that Pan-European commercial real estate values rose 5% in 2019 and are set to increase again by mid-single digits in 2020, with overall returns screening attractive relative to investment grade and high yield bonds.

Green Street’s outlook for Pan-European commercial property is now released with a new private market research product offering, European Real Estate Analytics. The platform provides market participants with a seamless way to compare and underwrite real estate investments across geographies, property sectors, and currencies. Covering the 25 top European markets, European Real Estate Analytics provides unbiased, third party analysis on property fundamentals and valuation through its report suite and interactive mapping and analytics platform, Atlas. It also includes coveted, proprietary market grades, which are not available through alternate providers.

- DOWNLOAD the full European Commercial Property Outlook report

- EXPLORE Green Street’s new European Real Estate Analytics platform

Green Street Advisors (UK) Ltd.

Green Street Advisors (UK) Limited is an affiliate of Green Street Advisors, LLC, which was founded in 1985 and is the preeminent independent research and advisory firm concentrating on the commercial real estate industry in Europe, the United Kingdom, and the United States. The company is a leading provider of real estate research, analytics, and data on both private and public markets. For more information, please visit www.greenstreetadvisors.com.

Green Street's US Research, Data, and Analytics products along with its global news publications are not provided as an investment advisor nor in the capacity of a fiduciary.